Tracking Microsoft's Financial Performance: A Closer Look at MSFT Stock Price Quote

Table of Contents

- Microsoft stock hits highest price since 1999 - Neowin

- Microsoft symbols stock market history - jquery set selected option not ...

- AI predicts Microsoft stock price for January 1, 2024

- Where Will Microsoft Stock Be In 5 Years? (NASDAQ:MSFT) | Seeking Alpha

- Microsoft Stock Price Forecast for 2025 and beyond

- Microsoft (MSFT) Stock Price Prediction 2023,2025,2030 — Is MSFT a Good ...

- Buy or Sell Microsoft as It Eyes Stake in ChatGPT Owner OpenAI? - TheStreet

- Microsoft symbols stock market history - jquery set selected option not ...

- Microsoft Stock Price Prediction with Machine Learning - GeeksforGeeks

- Microsoft's big earnings beat is because of one business that is ...

What is Microsoft's Current Stock Price Quote?

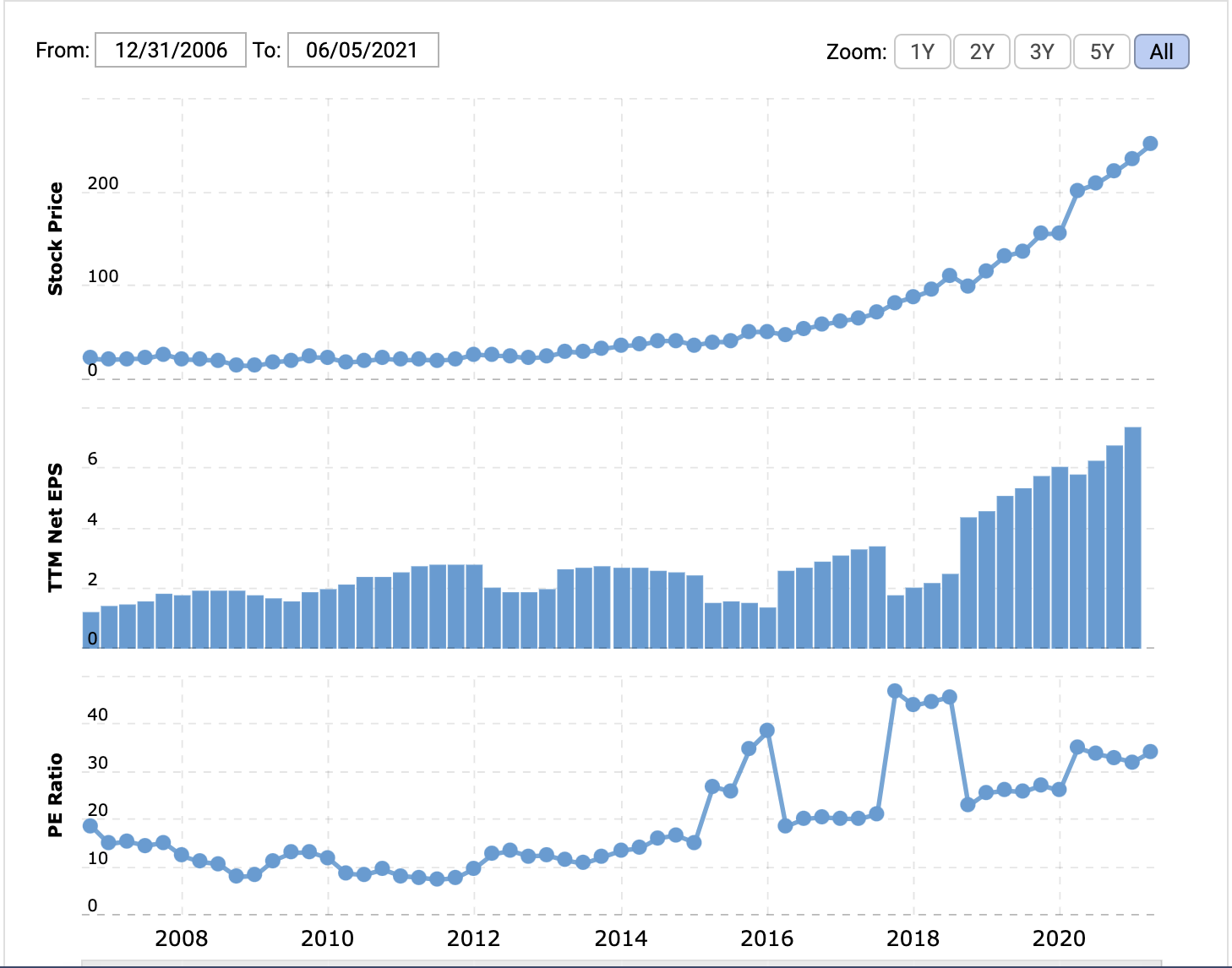

Understanding Microsoft's Stock Performance

Morningstar's Analysis of Microsoft's Stock Price Quote

Morningstar provides a detailed analysis of Microsoft's stock price quote, including its fair value estimate, moat rating, and valuation metrics. According to Morningstar, Microsoft's stock has a wide economic moat, which is a competitive advantage that allows the company to maintain its market share and profitability over time. The website also provides a fair value estimate of Microsoft's stock, which can help investors determine whether the stock is undervalued or overvalued.

Why Invest in Microsoft Stock?

Microsoft's stable financial performance, strong brand recognition, and dominant position in the technology industry make it an attractive investment opportunity for many investors. The company's diversified product portfolio, which includes Windows, Office, and Azure, provides a stable source of revenue and helps to mitigate risks. Additionally, Microsoft's commitment to innovation and research and development ensures that the company remains competitive in the rapidly evolving technology landscape. Microsoft's stock price quote on NASDAQ: MSFT is an important indicator of the company's financial performance and overall health. By tracking Microsoft's stock price quote on Morningstar, investors can gain valuable insights into the company's strengths and weaknesses, as well as its potential for future growth. Whether you're a seasoned investor or just starting to build your portfolio, Microsoft's stock is definitely worth considering. With its stable financial performance, strong brand recognition, and commitment to innovation, Microsoft is a solid investment opportunity that can provide long-term returns for investors.For the latest updates on Microsoft's stock price quote, visit the Morningstar website or check out the NASDAQ website for real-time data and in-depth analysis.

Note: The article is for informational purposes only and should not be considered as investment advice. Investors should do their own research and consult with a financial advisor before making any investment decisions.