Delivering Growth: A Comprehensive Analysis of United Parcel Service (UPS) Stock

Table of Contents

- UPS Stock Should Continue to Grace Your Portfolio: Here's Why

- United Parcel Service Stock And Its Real Value (NYSE:UPS) | Seeking Alpha

- UPS Stock Just Can’t Deliver in an Economic Collapse | InvestorPlace

- UPS Stock Price and Chart — NYSE:UPS — TradingView

- Checking in with United Parcel Service Stock Before Earnings

- Earnings Beat In Cards For UPS Stock?

- United Parcel Service Stock Analysis | UPS Stock Analysis - YouTube

- United Parcel Service Stock (UPS): Undervalued Dividend Giant With ...

- UPS | Free Stock Chart and Technical Analysis | TrendSpider

- UPS stock hits all-time high on soaring demand for delivery

Current Stock Price and Performance

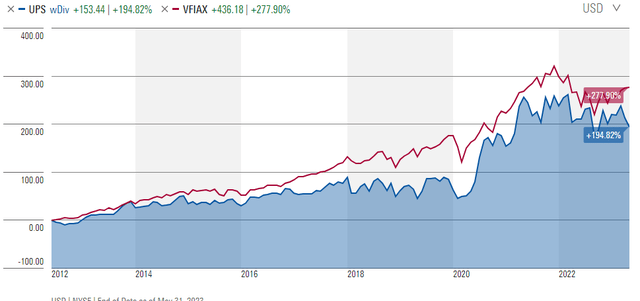

Historical Trends and Stock Analysis

Key Factors Influencing UPS Stock

Several factors can impact the performance of UPS stock, including: E-commerce Growth: The rise of online shopping has driven increased demand for logistics and delivery services, benefiting UPS and other industry players. Global Trade Policies: Changes in trade policies, such as tariffs and Brexit, can impact UPS's international operations and revenue. Fuel Prices: Fluctuations in fuel prices can affect UPS's operating costs and profitability. Competition: The logistics industry is highly competitive, with rival providers such as FedEx and Amazon Logistics vying for market share. In conclusion, United Parcel Service (UPS) stock offers a compelling investment opportunity, with a strong track record of growth and a solid dividend yield. While the company faces challenges and uncertainties, its ability to adapt and innovate has positioned it for long-term success. As the demand for e-commerce and logistics services continues to grow, UPS is well-placed to capitalize on these trends and deliver returns for investors. Whether you're a seasoned investor or just starting to build your portfolio, UPS stock is definitely worth considering.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to do your own research and consult with a financial advisor before making any investment decisions.